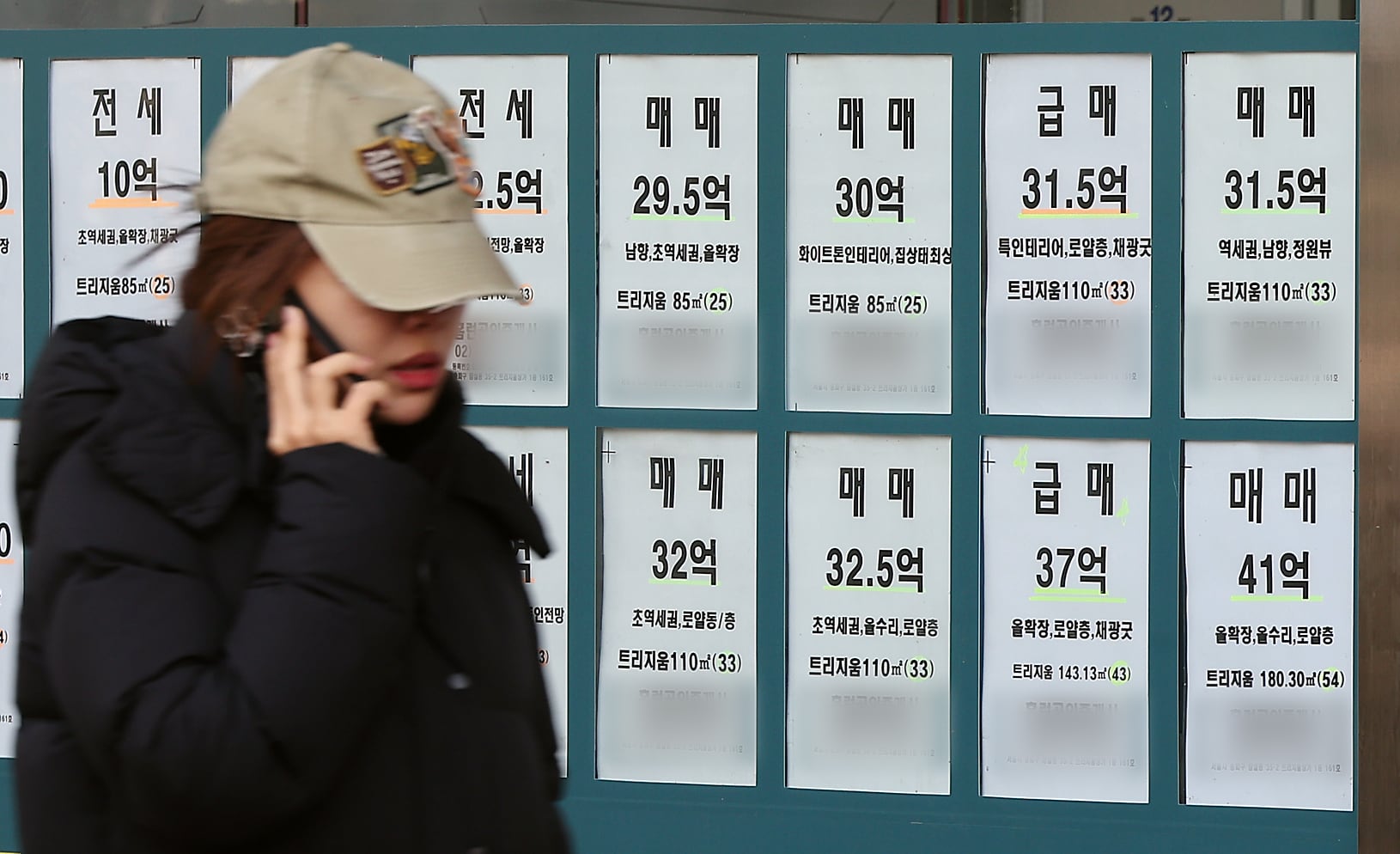

The rise in Seoul property prices, including apartments, last month was less than in the prior month. Nevertheless, jeonse prices experienced a greater increase due to reduced availability.

According to the nationwide housing price trend survey conducted in November and released by the Korea Real Estate Board on the 15th, the comprehensive housing (apartment, row house, and single-family home) sales price index in Seoul increased by 0.77% from the previous month. This growth rate was 0.42 percentage points lower than the previous month’s rate of 1.19%. In October, before and after the announcement of the “October 15 measures,” buying activity, including last-minute gap investments (purchasing homes with jeonse leases), concentrated along the Han River area, resulting in the highest growth rate since September 2018. The increase in the sales price index last month remained higher compared to August (0.45%) and September (0.58%). The Korea Real Estate Board stated, “Although market participants took a wait-and-see approach in Seoul, leading to fewer purchase inquiries and transactions, prices mainly rose in certain redevelopment-promoting complexes and desirable areas.”

The overall capital region’s growth rate decreased by 0.15 percentage points from 0.60% to 0.45% compared to the previous month. Gyeonggi Province, which moved from 0.34% to 0.32%, showed higher growth in newly regulated areas including Bundang-gu, Seongnam, Gwacheon, and Suji-gu, Yongin. Incheon saw a minor increase in its growth rate, rising from 0.07% to 0.09%.

After the release of the October 15 policies, the reduction in jeonse availability caused a more substantial rise in jeonse rates. In Seoul (0.44% → 0.51%), demand for rentals remained strong in desirable neighborhoods, including school districts with favorable living environments and locations close to subway stations, due to a limited number of available properties. Notable rises were recorded in Seocho-gu (1.24%), Songpa-gu (1.20%), Gangdong-gu (0.83%), Yangcheon-gu (0.82%), Yeongdeungpo-gu (0.71%), and Yongsan-gu (0.69%).

In Gyeonggi Province (0.24% → 0.32%), the cost of jeonse saw an increase, particularly in Hanam, Yeongtong-gu, Suwon, and Bundang-gu, Seongnam. In Incheon (0.14% → 0.23%), there was a rise in prices mainly in Seo-gu, Yeonsu-gu, and Namdong-gu.

Monthly rental costs in Seoul (0.53% → 0.52%) showed a comparable rate of increase, whereas Gyeonggi Province (0.20% → 0.28%) and Incheon (0.15% → 0.22%) saw higher rises, contributing to the capital area’s growth rate (0.30% → 0.35%).

The national overall housing sales price rose by 0.24%. Major areas experienced price hikes, including the five metropolitan cities (-0.01% to 0.04%), eight provinces (0.00% to 0.04%), and Sejong (0.02% to 0.11%). In Ulsan (0.37%), prices went up mainly in desirable complexes in Nam-gu and Buk-gu, while in Jeollabuk-do (0.25%), increases were observed in areas with favorable living conditions in Deokjin-gu and Wansan-gu, Jeonju. The national overall jeonse price growth rate was 0.24%, and the monthly rent price growth rate was 0.23%.